STRATEGICALLY ORIENTED. PERSONALLY ENGAGED.

Patterson is a capital placement and real estate finance advisory firm that helps extraordinary clients take advantage of exceptional real estate opportunities.

Patterson is a capital placement and real estate finance advisory firm that helps extraordinary clients take advantage of exceptional real estate opportunities.

Patterson is a capital placement and real estate finance advisory firm that helps extraordinary clients take advantage of exceptional real estate opportunities.

Patterson’s platform is founded on knowledge and skill formed over decades of experience in the capital markets. We work with clients to provide strategic financial analysis and counsel along with creative and appropriate capitalization structures.

Patterson represents commercial real estate owners and developers seeking to invest in real estate opportunities or navigate a challenging economic environment. Our primary focus is helping clients across all property types access investors at all levels of the capital stack, matching the specific need with the appropriate capital providers.

Since inception, Patterson has closed more than 550 transactions encompassing over $12.8 billion in capital placement and $19.5 billion in total transactional value. Whether sourcing debt, raising equity or executing a recapitalization, Patterson’s nuanced perspective enables us to understand the individual requirements of our clients and their assets in order to offer best-in-class counsel.

Our customized solutions often entail orchestrating all elements of the capital stack, including equity components. Whether sourcing Co-GP equity, LP equity or preferred equity, Patterson’s experience and relationships enable us to identify and structure compatible and enduring partnerships.

Patterson is active with all forms of debt in all levels of the capital stack:

• Construction debt

• Bridge debt

• Permanent debt

• Mezzanine debt

• A/B note structures

• Participating debt

• Forward commitments

Patterson’s financial advisory platform offers clients the opportunity to benefit from our principals’ breadth of skills and unique perspectives. Our comprehensive approach ensures that every angle is explored as we offer strategic and tailored financial solutions that few other advisors can. We have advised clients on:

• Loan restructurings

• Property acquisitions

• Note acquisitions

• Partnership structuring

• University consultation

• Property valuation

• General strategic consulting

• Buyer/Seller transaction consulting

• New development

• Opportunity zones

• Historic and new market tax credits

With offices in Atlanta, Charleston, Charlotte, Dallas, Nashville and Tampa, Patterson offers local and regional expertise to serve clients across its geographic footprint and beyond.

https://pattersonreag.com/wp-content/uploads/2026/02/Archer-at-RiverBlue.jpg

242

624

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

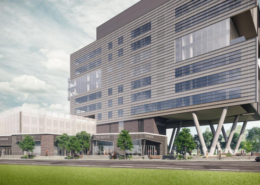

Erin Green2026-02-24 09:29:192026-02-24 09:31:36Patterson Secures Equity Financing For Archer at RiverBlue in Asheville, NC

https://pattersonreag.com/wp-content/uploads/2026/02/Archer-at-RiverBlue.jpg

242

624

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2026-02-24 09:29:192026-02-24 09:31:36Patterson Secures Equity Financing For Archer at RiverBlue in Asheville, NC https://pattersonreag.com/wp-content/uploads/2026/02/TAC-groundbreaking-1.jpg

690

1242

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2026-02-20 12:55:222026-02-20 12:55:35The Atlantic Companies Breaks Ground on 702 Manufactures Road

https://pattersonreag.com/wp-content/uploads/2026/02/TAC-groundbreaking-1.jpg

690

1242

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2026-02-20 12:55:222026-02-20 12:55:35The Atlantic Companies Breaks Ground on 702 Manufactures Road https://pattersonreag.com/wp-content/uploads/2024/07/Erin-cropped.jpg

1152

1152

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2026-01-29 09:04:392026-01-29 09:04:39Patterson Announces Promotion of Erin Green

https://pattersonreag.com/wp-content/uploads/2024/07/Erin-cropped.jpg

1152

1152

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2026-01-29 09:04:392026-01-29 09:04:39Patterson Announces Promotion of Erin Green https://pattersonreag.com/wp-content/uploads/2025/12/Collage-1-scaled.png

1382

2560

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-22 10:18:202025-12-22 10:18:20Patterson Arranges Senior Loan on Newly Built Multifamily Asset with Prime Finance

https://pattersonreag.com/wp-content/uploads/2025/12/Collage-1-scaled.png

1382

2560

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-22 10:18:202025-12-22 10:18:20Patterson Arranges Senior Loan on Newly Built Multifamily Asset with Prime Finance https://pattersonreag.com/wp-content/uploads/2025/12/ULI-SC-17th-Annual-Capital-markets-Conference-1.png

755

1087

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-16 08:58:482025-12-16 09:17:39Ken Grimes & Bill Mealor at ULI South Carolina’s 17th Annual Capital Markets Conference

https://pattersonreag.com/wp-content/uploads/2025/12/ULI-SC-17th-Annual-Capital-markets-Conference-1.png

755

1087

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-16 08:58:482025-12-16 09:17:39Ken Grimes & Bill Mealor at ULI South Carolina’s 17th Annual Capital Markets Conference https://pattersonreag.com/wp-content/uploads/2025/12/1819-Peachtree.png

397

598

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-09 09:33:522025-12-09 09:33:52Patterson Arranges Senior Bridge Loan Financing

https://pattersonreag.com/wp-content/uploads/2025/12/1819-Peachtree.png

397

598

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-09 09:33:522025-12-09 09:33:52Patterson Arranges Senior Bridge Loan Financing https://pattersonreag.com/wp-content/uploads/2025/12/Infill-Industrial-Portfolio.png

462

561

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-04 10:08:012025-12-04 10:08:01Patterson Arranges Financing for Charleston Infill Industrial Portfolio

https://pattersonreag.com/wp-content/uploads/2025/12/Infill-Industrial-Portfolio.png

462

561

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-12-04 10:08:012025-12-04 10:08:01Patterson Arranges Financing for Charleston Infill Industrial Portfolio https://pattersonreag.com/wp-content/uploads/2025/11/Recent-transactions-image-e1763650056767.png

248

599

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-11-20 09:48:142025-11-20 09:48:14Patterson Real Estate Advisory Group – Recent Transactions Fall 2025

https://pattersonreag.com/wp-content/uploads/2025/11/Recent-transactions-image-e1763650056767.png

248

599

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-11-20 09:48:142025-11-20 09:48:14Patterson Real Estate Advisory Group – Recent Transactions Fall 2025 https://pattersonreag.com/wp-content/uploads/2025/11/Vista-Residential-Mill-Grove-Vista-Image.png

496

971

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-11-18 09:52:462025-11-18 09:52:46Patterson Arranges Equity Financing for Mill Grove Vista in Mableton, GA

https://pattersonreag.com/wp-content/uploads/2025/11/Vista-Residential-Mill-Grove-Vista-Image.png

496

971

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-11-18 09:52:462025-11-18 09:52:46Patterson Arranges Equity Financing for Mill Grove Vista in Mableton, GA https://pattersonreag.com/wp-content/uploads/2025/11/Northbend-image-corporate-square.png

452

781

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-11-07 14:58:072025-11-11 09:19:46Patterson Secures Financing for Northbend in Brookhaven, GA

https://pattersonreag.com/wp-content/uploads/2025/11/Northbend-image-corporate-square.png

452

781

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-11-07 14:58:072025-11-11 09:19:46Patterson Secures Financing for Northbend in Brookhaven, GA https://pattersonreag.com/wp-content/uploads/2025/09/Ocean-Pines.png

401

714

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-16 09:43:102025-09-16 09:43:10Patterson Arranges Construction Loan for Ocean Pines on Kiawah Island, SC

https://pattersonreag.com/wp-content/uploads/2025/09/Ocean-Pines.png

401

714

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-16 09:43:102025-09-16 09:43:10Patterson Arranges Construction Loan for Ocean Pines on Kiawah Island, SC https://pattersonreag.com/wp-content/uploads/2025/09/Luke-Christian-Associate.png

1200

1200

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-11 09:33:102025-09-11 09:33:10Patterson’s Bennett Souter and Luke Christian Selected for Commercial Real Estate Leadership Programs

https://pattersonreag.com/wp-content/uploads/2025/09/Luke-Christian-Associate.png

1200

1200

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-11 09:33:102025-09-11 09:33:10Patterson’s Bennett Souter and Luke Christian Selected for Commercial Real Estate Leadership Programs https://pattersonreag.com/wp-content/uploads/2025/09/The-Sinclair-at-Ellenton.png

372

716

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-09 09:22:402025-09-09 09:24:27Patterson Arranges Senior Construction Loan & Equity Financing for The Sinclair at Ellenton in Ellenton, FL

https://pattersonreag.com/wp-content/uploads/2025/09/The-Sinclair-at-Ellenton.png

372

716

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-09 09:22:402025-09-09 09:24:27Patterson Arranges Senior Construction Loan & Equity Financing for The Sinclair at Ellenton in Ellenton, FL https://pattersonreag.com/wp-content/uploads/2025/09/Grace-Lewis-scaled.jpg

2560

2325

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-03 09:55:202025-09-03 09:55:20Patterson Announces Promotion of Grace Lewis

https://pattersonreag.com/wp-content/uploads/2025/09/Grace-Lewis-scaled.jpg

2560

2325

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-09-03 09:55:202025-09-03 09:55:20Patterson Announces Promotion of Grace Lewis https://pattersonreag.com/wp-content/uploads/2025/08/Newsletter-image.png

553

935

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-08-20 09:56:202025-08-20 09:56:20Patterson Issues Summer 2025 Edition of Newsletter: Capital Views

https://pattersonreag.com/wp-content/uploads/2025/08/Newsletter-image.png

553

935

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-08-20 09:56:202025-08-20 09:56:20Patterson Issues Summer 2025 Edition of Newsletter: Capital Views https://pattersonreag.com/wp-content/uploads/2025/08/PR-Rendering.png

445

691

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-08-12 09:27:412025-08-12 09:27:41Patterson Arranges Senior Construction Loan & Equity Financing for Drew Valley Townhomes in Brookhaven, GA

https://pattersonreag.com/wp-content/uploads/2025/08/PR-Rendering.png

445

691

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-08-12 09:27:412025-08-12 09:27:41Patterson Arranges Senior Construction Loan & Equity Financing for Drew Valley Townhomes in Brookhaven, GA https://pattersonreag.com/wp-content/uploads/2025/07/Magnolia-Grove-1.png

402

712

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-07-22 09:25:402025-07-22 09:26:12Patterson Sources Construction Financing for Magnolia Grove Industrial Development in Greenville SC

https://pattersonreag.com/wp-content/uploads/2025/07/Magnolia-Grove-1.png

402

712

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-07-22 09:25:402025-07-22 09:26:12Patterson Sources Construction Financing for Magnolia Grove Industrial Development in Greenville SC https://pattersonreag.com/wp-content/uploads/2025/07/Walker-Kathryn-and-Keene-Headshot.png

611

1603

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-07-15 10:12:272025-07-15 10:12:27Patterson Announces Promotion of Walker Saint and Welcomes New Team Members Kathryn Obrecht and Keene Cornick

https://pattersonreag.com/wp-content/uploads/2025/07/Walker-Kathryn-and-Keene-Headshot.png

611

1603

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-07-15 10:12:272025-07-15 10:12:27Patterson Announces Promotion of Walker Saint and Welcomes New Team Members Kathryn Obrecht and Keene Cornick https://pattersonreag.com/wp-content/uploads/2025/06/Marin-at-Waterfront-1.png

778

1175

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-06-09 09:31:012025-06-09 09:32:50East West Partners Breaks Ground on Fourth Phase of Master Planned Development

https://pattersonreag.com/wp-content/uploads/2025/06/Marin-at-Waterfront-1.png

778

1175

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-06-09 09:31:012025-06-09 09:32:50East West Partners Breaks Ground on Fourth Phase of Master Planned Development https://pattersonreag.com/wp-content/uploads/2025/06/Bellyard-Hotel.png

381

573

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-06-03 09:11:082025-06-03 09:11:08Patterson Arranges Financing for West Midtown Atlanta Hotel

https://pattersonreag.com/wp-content/uploads/2025/06/Bellyard-Hotel.png

381

573

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-06-03 09:11:082025-06-03 09:11:08Patterson Arranges Financing for West Midtown Atlanta Hotel https://pattersonreag.com/wp-content/uploads/2025/05/IMG_4501-1-scaled.png

2560

1920

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-05-15 09:10:372025-05-15 09:33:25Todd Flaman Serves as Panelist for BisNow’s Atlanta State of the Market

https://pattersonreag.com/wp-content/uploads/2025/05/IMG_4501-1-scaled.png

2560

1920

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-05-15 09:10:372025-05-15 09:33:25Todd Flaman Serves as Panelist for BisNow’s Atlanta State of the Market https://pattersonreag.com/wp-content/uploads/2025/05/Press-Release-Image.png

1843

3528

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-05-06 09:39:542025-05-06 09:39:54Patterson Sources Financing for the Refinance of an Adaptive Reuse Retail and Office Property in Atlanta GA

https://pattersonreag.com/wp-content/uploads/2025/05/Press-Release-Image.png

1843

3528

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-05-06 09:39:542025-05-06 09:39:54Patterson Sources Financing for the Refinance of an Adaptive Reuse Retail and Office Property in Atlanta GA https://pattersonreag.com/wp-content/uploads/2025/05/Recent-Transactions-Image.png

791

932

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-05-01 08:54:562025-05-01 08:54:56Patterson Real Estate Advisory Group – Recent Transactions Spring 2025

https://pattersonreag.com/wp-content/uploads/2025/05/Recent-Transactions-Image.png

791

932

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-05-01 08:54:562025-05-01 08:54:56Patterson Real Estate Advisory Group – Recent Transactions Spring 2025 https://pattersonreag.com/wp-content/uploads/2025/04/UGA-young-alumni-panel.png

900

1698

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-04-22 09:52:102025-04-22 09:52:10Chance Gordon Serves as Panelist for UGA’s Terry College of Business Young Alumni Panel

https://pattersonreag.com/wp-content/uploads/2025/04/UGA-young-alumni-panel.png

900

1698

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-04-22 09:52:102025-04-22 09:52:10Chance Gordon Serves as Panelist for UGA’s Terry College of Business Young Alumni Panel https://pattersonreag.com/wp-content/uploads/2025/03/Highland-Magnolia.png

502

757

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-03-04 11:29:492025-03-04 11:29:49Highland Resources Breaks Ground on Magnolia Landing in Charleston, SC

https://pattersonreag.com/wp-content/uploads/2025/03/Highland-Magnolia.png

502

757

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-03-04 11:29:492025-03-04 11:29:49Highland Resources Breaks Ground on Magnolia Landing in Charleston, SC https://pattersonreag.com/wp-content/uploads/2025/03/Newsletter-Image_FINAL.png

609

938

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-03-03 09:31:382025-03-03 09:31:38Patterson Issues Winter 2025 Edition of Newsletter: Capital Views

https://pattersonreag.com/wp-content/uploads/2025/03/Newsletter-Image_FINAL.png

609

938

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-03-03 09:31:382025-03-03 09:31:38Patterson Issues Winter 2025 Edition of Newsletter: Capital Views https://pattersonreag.com/wp-content/uploads/2025/02/Co-Managing-Partner.png

3375

2700

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

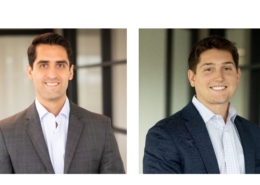

Erin Green2025-02-06 10:00:102025-02-10 12:06:50Patterson Appoints Bill Mealor and Todd Flaman as Co-Managing Partners

https://pattersonreag.com/wp-content/uploads/2025/02/Co-Managing-Partner.png

3375

2700

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-02-06 10:00:102025-02-10 12:06:50Patterson Appoints Bill Mealor and Todd Flaman as Co-Managing Partners https://pattersonreag.com/wp-content/uploads/2025/01/Laura-Friddell-and-Bennett-Souter-Images-e1738253354990.png

301

531

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-01-30 11:15:052025-01-30 11:15:21Patterson Announces Promotions of Laura Friddell to Managing Director and Bennett Souter to Associate

https://pattersonreag.com/wp-content/uploads/2025/01/Laura-Friddell-and-Bennett-Souter-Images-e1738253354990.png

301

531

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-01-30 11:15:052025-01-30 11:15:21Patterson Announces Promotions of Laura Friddell to Managing Director and Bennett Souter to Associate https://pattersonreag.com/wp-content/uploads/2025/01/Capital-City-Commerce-Park.png

713

870

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-01-14 11:12:112025-01-14 13:20:30Patterson Completes 500th Transaction with Closing of Capital Circle Commerce Park in Tallahassee Florida

https://pattersonreag.com/wp-content/uploads/2025/01/Capital-City-Commerce-Park.png

713

870

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-01-14 11:12:112025-01-14 13:20:30Patterson Completes 500th Transaction with Closing of Capital Circle Commerce Park in Tallahassee Florida https://pattersonreag.com/wp-content/uploads/2025/01/PR-Image.png

1339

3630

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-01-08 17:13:432025-01-08 17:13:43Patterson Arranges Floating Rate Loan on Newly Built and Fully Leased Multifamily Asset in Brookhaven, GA

https://pattersonreag.com/wp-content/uploads/2025/01/PR-Image.png

1339

3630

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2025-01-08 17:13:432025-01-08 17:13:43Patterson Arranges Floating Rate Loan on Newly Built and Fully Leased Multifamily Asset in Brookhaven, GA https://pattersonreag.com/wp-content/uploads/2024/12/Untitled-design-2.png

625

625

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-13 11:06:172024-12-13 11:06:17Ken Grimes & Lance Patterson at ULI South Carolina’s 16th Annual Capital Markets Conference

https://pattersonreag.com/wp-content/uploads/2024/12/Untitled-design-2.png

625

625

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-13 11:06:172024-12-13 11:06:17Ken Grimes & Lance Patterson at ULI South Carolina’s 16th Annual Capital Markets Conference https://pattersonreag.com/wp-content/uploads/2024/12/river-hills.png

261

850

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-06 13:43:182024-12-06 13:43:18Patterson Arranges Construction Financing For HoM at River Hills in Tampa, FL

https://pattersonreag.com/wp-content/uploads/2024/12/river-hills.png

261

850

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-06 13:43:182024-12-06 13:43:18Patterson Arranges Construction Financing For HoM at River Hills in Tampa, FL https://pattersonreag.com/wp-content/uploads/2024/12/Prime-West.png

441

742

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-05 09:07:372024-12-05 09:12:19Patterson Arranges Financing from EB5 Capital For Multifamily Development in Avon, Colorado

https://pattersonreag.com/wp-content/uploads/2024/12/Prime-West.png

441

742

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-05 09:07:372024-12-05 09:12:19Patterson Arranges Financing from EB5 Capital For Multifamily Development in Avon, Colorado https://pattersonreag.com/wp-content/uploads/2024/12/3335-Dogwood-Drive.png

212

694

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-03 09:31:062024-12-03 09:31:06Patterson Real Estate Advisory Group Arranges Fee Development Agreement for a Build-To-Rent Community in Hapeville, Georgia

https://pattersonreag.com/wp-content/uploads/2024/12/3335-Dogwood-Drive.png

212

694

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-12-03 09:31:062024-12-03 09:31:06Patterson Real Estate Advisory Group Arranges Fee Development Agreement for a Build-To-Rent Community in Hapeville, Georgia https://pattersonreag.com/wp-content/uploads/2024/11/Lance-biznow-scaled.jpg

2560

1920

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-11-22 08:44:552024-11-22 08:44:55Lance Patterson Serves as Panelist for BisNow’s Atlanta Construction & Development Summit

https://pattersonreag.com/wp-content/uploads/2024/11/Lance-biznow-scaled.jpg

2560

1920

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-11-22 08:44:552024-11-22 08:44:55Lance Patterson Serves as Panelist for BisNow’s Atlanta Construction & Development Summit https://pattersonreag.com/wp-content/uploads/2024/11/41-fant.png

433

763

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-11-21 10:09:072024-11-21 10:09:07Patterson Real Estate Advisory Group Secures Debt Financing for Industrial Outdoor Storage Site in Madison, Tennessee

https://pattersonreag.com/wp-content/uploads/2024/11/41-fant.png

433

763

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-11-21 10:09:072024-11-21 10:09:07Patterson Real Estate Advisory Group Secures Debt Financing for Industrial Outdoor Storage Site in Madison, Tennessee https://pattersonreag.com/wp-content/uploads/2024/10/Wolves-of-Wall-Street-event-scaled.jpeg

1920

2560

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-10-23 08:56:552024-10-23 10:23:02Dylan Suth Serves as Panelist for University of West Georgia’s Wolves of Wall Street event

https://pattersonreag.com/wp-content/uploads/2024/10/Wolves-of-Wall-Street-event-scaled.jpeg

1920

2560

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-10-23 08:56:552024-10-23 10:23:02Dylan Suth Serves as Panelist for University of West Georgia’s Wolves of Wall Street event https://pattersonreag.com/wp-content/uploads/2024/10/madison-charlottesville.png

390

703

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-10-07 08:40:452024-10-11 09:58:10Patterson Real Estate Advisory Group Sources Construction Financing For Multifamily Community in Charlottesville Virginia

https://pattersonreag.com/wp-content/uploads/2024/10/madison-charlottesville.png

390

703

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-10-07 08:40:452024-10-11 09:58:10Patterson Real Estate Advisory Group Sources Construction Financing For Multifamily Community in Charlottesville Virginia https://pattersonreag.com/wp-content/uploads/2024/09/OneStreet-Holly-Springs.png

570

972

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-27 10:01:182024-09-27 10:01:18Patterson Real Estate Advisory Group Arranges Senior Debt Construction Financing For 55+ Cottage Development in Holly Springs Georgia

https://pattersonreag.com/wp-content/uploads/2024/09/OneStreet-Holly-Springs.png

570

972

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-27 10:01:182024-09-27 10:01:18Patterson Real Estate Advisory Group Arranges Senior Debt Construction Financing For 55+ Cottage Development in Holly Springs Georgia https://pattersonreag.com/wp-content/uploads/2024/09/Nowell-Creek-1.png

692

1253

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-26 16:20:092024-09-26 16:20:09East West Partners and Holder Begin on Dwellings at Nowell Creek in Daniel Island South Carolina

https://pattersonreag.com/wp-content/uploads/2024/09/Nowell-Creek-1.png

692

1253

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-26 16:20:092024-09-26 16:20:09East West Partners and Holder Begin on Dwellings at Nowell Creek in Daniel Island South Carolina https://pattersonreag.com/wp-content/uploads/2024/09/Dream-Headshot-scaled-e1726844687487.jpg

1237

1211

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-23 10:54:032024-09-23 10:54:03Welcoming Our Fall 2024 Intern, Dream Nelson!

https://pattersonreag.com/wp-content/uploads/2024/09/Dream-Headshot-scaled-e1726844687487.jpg

1237

1211

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-23 10:54:032024-09-23 10:54:03Welcoming Our Fall 2024 Intern, Dream Nelson! https://pattersonreag.com/wp-content/uploads/2024/09/Lumen-Legacy-Park-representative-image.png

344

661

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-11 08:46:512024-10-10 16:33:39Patterson Real Estate Advisory Group Sources Construction Financing for a Multifamily Development in Davenport Florida

https://pattersonreag.com/wp-content/uploads/2024/09/Lumen-Legacy-Park-representative-image.png

344

661

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-09-11 08:46:512024-10-10 16:33:39Patterson Real Estate Advisory Group Sources Construction Financing for a Multifamily Development in Davenport Florida https://pattersonreag.com/wp-content/uploads/2024/08/ESDSJC-1-1.png

1080

1920

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-28 08:58:132024-09-03 16:30:47Patterson’s Emily Shelton, Dylan Suth, and Jamie Campbell Selected for Commercial Real Estate Leadership Programs

https://pattersonreag.com/wp-content/uploads/2024/08/ESDSJC-1-1.png

1080

1920

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-28 08:58:132024-09-03 16:30:47Patterson’s Emily Shelton, Dylan Suth, and Jamie Campbell Selected for Commercial Real Estate Leadership Programs https://pattersonreag.com/wp-content/uploads/2024/08/UWG-event.jpg

829

825

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-27 08:40:462024-08-28 09:54:36Dylan Suth to participate in UWG’s ‘Wolves of Wall Street’ Event

https://pattersonreag.com/wp-content/uploads/2024/08/UWG-event.jpg

829

825

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-27 08:40:462024-08-28 09:54:36Dylan Suth to participate in UWG’s ‘Wolves of Wall Street’ Event https://pattersonreag.com/wp-content/uploads/2024/08/Newstar-e1724258030933.jpg

358

478

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-21 11:40:292024-08-21 15:13:12Patterson Real Estate Advisory Group Assists with Capitalization for Charlotte Build-to Rent Developments

https://pattersonreag.com/wp-content/uploads/2024/08/Newstar-e1724258030933.jpg

358

478

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-21 11:40:292024-08-21 15:13:12Patterson Real Estate Advisory Group Assists with Capitalization for Charlotte Build-to Rent Developments https://pattersonreag.com/wp-content/uploads/2024/08/rail-gauge.png

595

936

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-21 11:36:592024-08-21 15:13:27Patterson Real Estate Advisory Group Sources Construction Financing for a Multifamily Development in Fort Myers Florida

https://pattersonreag.com/wp-content/uploads/2024/08/rail-gauge.png

595

936

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-08-21 11:36:592024-08-21 15:13:27Patterson Real Estate Advisory Group Sources Construction Financing for a Multifamily Development in Fort Myers Florida https://pattersonreag.com/wp-content/uploads/2024/07/Capital-views-image-2.jpg

923

825

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-07-30 11:30:312024-08-21 16:42:46Patterson Issues Summer 2024 Edition of Newsletter: Capital Views

https://pattersonreag.com/wp-content/uploads/2024/07/Capital-views-image-2.jpg

923

825

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-07-30 11:30:312024-08-21 16:42:46Patterson Issues Summer 2024 Edition of Newsletter: Capital Views https://pattersonreag.com/wp-content/uploads/2024/07/Your-paragraph-text-1-2.png

553

941

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-07-23 11:09:522024-08-21 16:43:08Patterson Welcomes New Team Members Erin Green and Chance Gordon

https://pattersonreag.com/wp-content/uploads/2024/07/Your-paragraph-text-1-2.png

553

941

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-07-23 11:09:522024-08-21 16:43:08Patterson Welcomes New Team Members Erin Green and Chance Gordon https://pattersonreag.com/wp-content/uploads/2024/07/June-promotions-image-e1721136522744.jpg

783

931

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

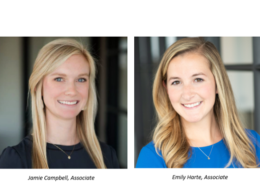

Erin Green2024-07-16 10:24:552024-08-21 15:32:20Patterson Announces Promotions of Jamie Campbell, Emily Harte Shelton, Katie Busch, Luke Christian and Grace Lewis

https://pattersonreag.com/wp-content/uploads/2024/07/June-promotions-image-e1721136522744.jpg

783

931

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-07-16 10:24:552024-08-21 15:32:20Patterson Announces Promotions of Jamie Campbell, Emily Harte Shelton, Katie Busch, Luke Christian and Grace Lewis https://pattersonreag.com/wp-content/uploads/2024/07/daniel-island-phase-3-e1720646012769.jpg

466

937

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-07-10 17:25:542024-08-21 15:33:09Patterson Sources Construction Financing for Phase III of The Waterfront Daniel Island Development

https://pattersonreag.com/wp-content/uploads/2024/07/daniel-island-phase-3-e1720646012769.jpg

466

937

Erin Green

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Erin Green2024-07-10 17:25:542024-08-21 15:33:09Patterson Sources Construction Financing for Phase III of The Waterfront Daniel Island Development https://pattersonreag.com/wp-content/uploads/2024/07/Sawmill-project.png

696

1248

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2024-07-09 13:09:352024-08-21 15:36:10Patterson Real Estate Advisory Group Sources Equity for New Summerville, SC Mixed-Use Development

https://pattersonreag.com/wp-content/uploads/2024/07/Sawmill-project.png

696

1248

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2024-07-09 13:09:352024-08-21 15:36:10Patterson Real Estate Advisory Group Sources Equity for New Summerville, SC Mixed-Use Development https://pattersonreag.com/wp-content/uploads/2024/06/100-Midtown-photo.jpg

506

900

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-06-20 09:55:592024-08-21 15:36:31Patterson Assists with JV Equity Raise for Student Housing Acquisition in Atlanta

https://pattersonreag.com/wp-content/uploads/2024/06/100-Midtown-photo.jpg

506

900

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-06-20 09:55:592024-08-21 15:36:31Patterson Assists with JV Equity Raise for Student Housing Acquisition in Atlanta https://pattersonreag.com/wp-content/uploads/2024/05/Lauren-and-Austin-Photo.png

735

1223

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-05-22 09:19:062024-08-21 15:22:30Patterson Announces New Partners Lauren Hanley and Austin Smith

https://pattersonreag.com/wp-content/uploads/2024/05/Lauren-and-Austin-Photo.png

735

1223

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-05-22 09:19:062024-08-21 15:22:30Patterson Announces New Partners Lauren Hanley and Austin Smith https://pattersonreag.com/wp-content/uploads/2024/05/TRUX.jpg

380

550

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-05-15 09:07:132024-08-21 15:38:21Patterson Real Estate Advisory Group Sources Debt Financing for Three IOS Sites

https://pattersonreag.com/wp-content/uploads/2024/05/TRUX.jpg

380

550

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-05-15 09:07:132024-08-21 15:38:21Patterson Real Estate Advisory Group Sources Debt Financing for Three IOS Sites https://pattersonreag.com/wp-content/uploads/2024/05/BizNow-Panel-Photo-scaled.jpg

1698

2560

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-05-14 16:44:542024-08-28 09:54:37Bill Mealor Serves as Panelist for BizNow’s Industrial Southeast Summit

https://pattersonreag.com/wp-content/uploads/2024/05/BizNow-Panel-Photo-scaled.jpg

1698

2560

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-05-14 16:44:542024-08-28 09:54:37Bill Mealor Serves as Panelist for BizNow’s Industrial Southeast Summit https://pattersonreag.com/wp-content/uploads/2024/04/Panel-Photo.jpg

1512

2016

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-04-16 09:50:082024-08-28 09:54:37Patterson’s Lauren Hanley Participates on Tampa Panel for Chicago Booth School of Business

https://pattersonreag.com/wp-content/uploads/2024/04/Panel-Photo.jpg

1512

2016

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-04-16 09:50:082024-08-28 09:54:37Patterson’s Lauren Hanley Participates on Tampa Panel for Chicago Booth School of Business https://pattersonreag.com/wp-content/uploads/2024/03/Peeples-Rendering-Final-002.jpg

1440

2560

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-03-06 10:09:122024-08-21 15:45:22Patterson Real Estate Advisory Group Assists with Capitalization for 97-unit Build-for-Rent Townhome Development in Cartersville, GA

https://pattersonreag.com/wp-content/uploads/2024/03/Peeples-Rendering-Final-002.jpg

1440

2560

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-03-06 10:09:122024-08-21 15:45:22Patterson Real Estate Advisory Group Assists with Capitalization for 97-unit Build-for-Rent Townhome Development in Cartersville, GA https://pattersonreag.com/wp-content/uploads/2024/03/ULI-Carolinas.jpg

501

843

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-03-04 08:55:562024-08-28 09:54:43Patterson Founder and CEO Speaks at ULI Carolinas Meeting

https://pattersonreag.com/wp-content/uploads/2024/03/ULI-Carolinas.jpg

501

843

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-03-04 08:55:562024-08-28 09:54:43Patterson Founder and CEO Speaks at ULI Carolinas Meeting https://pattersonreag.com/wp-content/uploads/2024/03/GSU-Scholarship_Kaitlin-Novak.png

408

670

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-03-01 11:09:222024-08-21 15:47:05Georgia State University Awards the Patterson Real Estate Advisory Group Scholarship to Kaitlin Novak

https://pattersonreag.com/wp-content/uploads/2024/03/GSU-Scholarship_Kaitlin-Novak.png

408

670

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-03-01 11:09:222024-08-21 15:47:05Georgia State University Awards the Patterson Real Estate Advisory Group Scholarship to Kaitlin Novak https://pattersonreag.com/wp-content/uploads/2024/02/Winter-2024-Newsletter_1.png

720

650

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-02-29 11:37:002024-08-21 15:49:56Patterson Issues Winter 2024 Edition of Newsletter: Capital Views

https://pattersonreag.com/wp-content/uploads/2024/02/Winter-2024-Newsletter_1.png

720

650

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-02-29 11:37:002024-08-21 15:49:56Patterson Issues Winter 2024 Edition of Newsletter: Capital Views https://pattersonreag.com/wp-content/uploads/2024/02/Nowell-Creek.png

703

1058

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-02-26 11:45:422024-08-28 09:57:34Patterson Arranges Financing for Luxury BFR Townhome Development on Daniel Island, Charleston, SC

https://pattersonreag.com/wp-content/uploads/2024/02/Nowell-Creek.png

703

1058

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-02-26 11:45:422024-08-28 09:57:34Patterson Arranges Financing for Luxury BFR Townhome Development on Daniel Island, Charleston, SC https://pattersonreag.com/wp-content/uploads/2024/02/Picture1.png

597

937

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

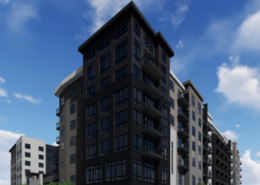

Suzanne Holman2024-02-15 15:03:582024-08-28 09:59:41Patterson Brokers $80,000,000 Construction Loan for 320-Unit Multifamily Development in Charlotte, NC

https://pattersonreag.com/wp-content/uploads/2024/02/Picture1.png

597

937

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-02-15 15:03:582024-08-28 09:59:41Patterson Brokers $80,000,000 Construction Loan for 320-Unit Multifamily Development in Charlotte, NC https://pattersonreag.com/wp-content/uploads/2024/02/BONITA-SPRINGS.jpg

878

880

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-02-12 09:00:322024-08-28 10:04:37Patterson Sources $44,000,000 Financing for 252-Unit Multifamily Development in Bonita Springs, Florida

https://pattersonreag.com/wp-content/uploads/2024/02/BONITA-SPRINGS.jpg

878

880

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-02-12 09:00:322024-08-28 10:04:37Patterson Sources $44,000,000 Financing for 252-Unit Multifamily Development in Bonita Springs, Florida https://pattersonreag.com/wp-content/uploads/2024/01/Jacaranda.png

720

1342

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-23 11:35:252024-08-21 15:51:22Patterson Arranges Financing for 216-Unit Infill Multifamily Development in Venice, FL

https://pattersonreag.com/wp-content/uploads/2024/01/Jacaranda.png

720

1342

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-23 11:35:252024-08-21 15:51:22Patterson Arranges Financing for 216-Unit Infill Multifamily Development in Venice, FL https://pattersonreag.com/wp-content/uploads/2024/01/Claire.png

778

811

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-18 09:16:052024-08-21 15:58:37Patterson Announces Promotion of Claire Cressman

https://pattersonreag.com/wp-content/uploads/2024/01/Claire.png

778

811

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-18 09:16:052024-08-21 15:58:37Patterson Announces Promotion of Claire Cressman https://pattersonreag.com/wp-content/uploads/2024/01/Cogswell.png

890

669

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-09 14:04:422024-08-21 15:59:40Longtime Friend of Patterson, William Cogswell, Sworn in as Mayor of Charleston

https://pattersonreag.com/wp-content/uploads/2024/01/Cogswell.png

890

669

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-09 14:04:422024-08-21 15:59:40Longtime Friend of Patterson, William Cogswell, Sworn in as Mayor of Charleston https://pattersonreag.com/wp-content/uploads/2024/01/Laura-and-Lauren_Jan-2024-Promotion.png

720

1280

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-09 08:38:102024-08-21 16:00:49Patterson Announces Promotions of Laura Cloud and Lauren Hanley

https://pattersonreag.com/wp-content/uploads/2024/01/Laura-and-Lauren_Jan-2024-Promotion.png

720

1280

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2024-01-09 08:38:102024-08-21 16:00:49Patterson Announces Promotions of Laura Cloud and Lauren Hanley https://pattersonreag.com/wp-content/uploads/2023/12/Bennett.png

411

456

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-12-20 09:18:162024-08-21 16:01:11Patterson Welcomes New Employee Bennett Souter

https://pattersonreag.com/wp-content/uploads/2023/12/Bennett.png

411

456

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-12-20 09:18:162024-08-21 16:01:11Patterson Welcomes New Employee Bennett Souter https://pattersonreag.com/wp-content/uploads/2023/12/Lauren-Hanley.png

402

504

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-12-01 10:11:512024-08-21 16:02:03Lauren Hanley Appointed to ULI Tampa Bay Executive Board

https://pattersonreag.com/wp-content/uploads/2023/12/Lauren-Hanley.png

402

504

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-12-01 10:11:512024-08-21 16:02:03Lauren Hanley Appointed to ULI Tampa Bay Executive Board https://pattersonreag.com/wp-content/uploads/2023/11/River-Park-10.jpg

805

1430

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-30 13:30:052024-08-21 16:03:25Patterson Brokers Construction Financing for 825,000 SF Industrial Development in Jackson, GA

https://pattersonreag.com/wp-content/uploads/2023/11/River-Park-10.jpg

805

1430

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-30 13:30:052024-08-21 16:03:25Patterson Brokers Construction Financing for 825,000 SF Industrial Development in Jackson, GA https://pattersonreag.com/wp-content/uploads/2023/11/Legacy-South.png

789

1407

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-30 10:17:142024-08-21 16:09:23Patterson Assists Legacy South Close $30,000,000 Capital Raise

https://pattersonreag.com/wp-content/uploads/2023/11/Legacy-South.png

789

1407

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-30 10:17:142024-08-21 16:09:23Patterson Assists Legacy South Close $30,000,000 Capital Raise https://pattersonreag.com/wp-content/uploads/2023/11/Austin-1-1.png

746

938

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-29 08:46:002024-08-21 16:12:35Patterson Announces Austin Smith as New Market Director in Charlotte

https://pattersonreag.com/wp-content/uploads/2023/11/Austin-1-1.png

746

938

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-29 08:46:002024-08-21 16:12:35Patterson Announces Austin Smith as New Market Director in Charlotte https://pattersonreag.com/wp-content/uploads/2023/11/Kiawah-2023.png

726

1300

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-20 10:34:232024-08-21 16:13:27Patterson’s Ken Grimes and East West Partners’ Katie Blum Co-Chair ULI South Carolina Capital Markets Conference

https://pattersonreag.com/wp-content/uploads/2023/11/Kiawah-2023.png

726

1300

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-11-20 10:34:232024-08-21 16:13:27Patterson’s Ken Grimes and East West Partners’ Katie Blum Co-Chair ULI South Carolina Capital Markets Conference https://pattersonreag.com/wp-content/uploads/2023/10/Tampa_126th_Ave.jpg

506

900

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-10-13 16:46:522024-08-21 16:13:56Patterson Facilitates Albany Road’s Acquisition of 30-Acre Industrial Site in Pinellas Park

https://pattersonreag.com/wp-content/uploads/2023/10/Tampa_126th_Ave.jpg

506

900

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-10-13 16:46:522024-08-21 16:13:56Patterson Facilitates Albany Road’s Acquisition of 30-Acre Industrial Site in Pinellas Park https://pattersonreag.com/wp-content/uploads/2022/10/Patterson_Compass_lightblueBg1065x700.jpg

700

1065

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-09-18 09:26:152024-08-21 16:14:38Patterson Arranges $100 Million Guidance Facility for IOS Portfolio Acquisition

https://pattersonreag.com/wp-content/uploads/2022/10/Patterson_Compass_lightblueBg1065x700.jpg

700

1065

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-09-18 09:26:152024-08-21 16:14:38Patterson Arranges $100 Million Guidance Facility for IOS Portfolio Acquisition https://pattersonreag.com/wp-content/uploads/2023/08/Luke_Promotion.png

506

653

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-29 13:26:492024-08-21 16:19:12Patterson Announces Promotion of Luke Christian to Senior Analyst

https://pattersonreag.com/wp-content/uploads/2023/08/Luke_Promotion.png

506

653

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-29 13:26:492024-08-21 16:19:12Patterson Announces Promotion of Luke Christian to Senior Analyst https://pattersonreag.com/wp-content/uploads/2023/08/West-Park-2.jpg

679

1023

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-07 13:58:452024-08-21 16:21:19Patterson Brokers Equity Financing for Build-to-Rent Townhome Development in Augusta, GA

https://pattersonreag.com/wp-content/uploads/2023/08/West-Park-2.jpg

679

1023

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-07 13:58:452024-08-21 16:21:19Patterson Brokers Equity Financing for Build-to-Rent Townhome Development in Augusta, GA https://pattersonreag.com/wp-content/uploads/2023/08/Hunter-Industrial.png

828

1251

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-04 09:56:572024-08-21 16:21:45Patterson Arranges Financing for Industrial Park in Laurens, SC

https://pattersonreag.com/wp-content/uploads/2023/08/Hunter-Industrial.png

828

1251

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-04 09:56:572024-08-21 16:21:45Patterson Arranges Financing for Industrial Park in Laurens, SC https://pattersonreag.com/wp-content/uploads/2023/08/The-Kelly.png

920

1383

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-02 10:49:332024-08-21 16:25:31Patterson Facilitates Equity Financing for Multifamily Development in Panama City, FL

https://pattersonreag.com/wp-content/uploads/2023/08/The-Kelly.png

920

1383

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-08-02 10:49:332024-08-21 16:25:31Patterson Facilitates Equity Financing for Multifamily Development in Panama City, FL https://pattersonreag.com/wp-content/uploads/2023/07/Summer_Newsletter_2023.png

849

672

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-07-26 10:33:232024-08-21 11:53:02Patterson Issues Summer 2023 Edition of Newsletter: Capital Views

https://pattersonreag.com/wp-content/uploads/2023/07/Summer_Newsletter_2023.png

849

672

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-07-26 10:33:232024-08-21 11:53:02Patterson Issues Summer 2023 Edition of Newsletter: Capital Views https://pattersonreag.com/wp-content/uploads/2023/07/Walker-3.jpg

665

679

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-07-20 13:34:072024-08-21 16:26:00Patterson Welcomes New Employee Walker Saint

https://pattersonreag.com/wp-content/uploads/2023/07/Walker-3.jpg

665

679

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-07-20 13:34:072024-08-21 16:26:00Patterson Welcomes New Employee Walker Saint

https://pattersonreag.com/wp-content/uploads/2023/06/Lance-Image-1.jpg

1080

1620

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-06-30 12:03:052024-08-28 10:13:23Lance Patterson Serves as Panelist for NAIOP Georgia’s June Meeting

https://pattersonreag.com/wp-content/uploads/2023/06/Lance-Image-1.jpg

1080

1620

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-06-30 12:03:052024-08-28 10:13:23Lance Patterson Serves as Panelist for NAIOP Georgia’s June Meeting https://pattersonreag.com/wp-content/uploads/2023/06/Savannah-IOS.png

644

1065

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-06-29 09:18:272024-08-21 16:33:23Patterson Sources Acquisition Financing for IOS Portfolio in Savannah

https://pattersonreag.com/wp-content/uploads/2023/06/Savannah-IOS.png

644

1065

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-06-29 09:18:272024-08-21 16:33:23Patterson Sources Acquisition Financing for IOS Portfolio in Savannah https://pattersonreag.com/wp-content/uploads/2023/06/Hadley-Crossing.jpg

703

783

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-06-28 09:28:552024-08-21 16:33:59Patterson Arranges Financing for Build-to-Rent Development in Charlotte, NC

https://pattersonreag.com/wp-content/uploads/2023/06/Hadley-Crossing.jpg

703

783

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-06-28 09:28:552024-08-21 16:33:59Patterson Arranges Financing for Build-to-Rent Development in Charlotte, NC https://pattersonreag.com/wp-content/uploads/2023/05/Lance-Panelist.png

548

868

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-05-31 14:04:302024-08-28 10:15:04Lance Patterson Serves as Panelist for Auburn University Real Estate and Logistics Symposium

https://pattersonreag.com/wp-content/uploads/2023/05/Lance-Panelist.png

548

868

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-05-31 14:04:302024-08-28 10:15:04Lance Patterson Serves as Panelist for Auburn University Real Estate and Logistics Symposium https://pattersonreag.com/wp-content/uploads/2023/05/ULI-Leadership.png

407

610

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-05-12 17:06:052024-08-21 16:46:51Javi Morales Graduates from the ULI Atlanta Center for Leadership Program

https://pattersonreag.com/wp-content/uploads/2023/05/ULI-Leadership.png

407

610

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-05-12 17:06:052024-08-21 16:46:51Javi Morales Graduates from the ULI Atlanta Center for Leadership Program https://pattersonreag.com/wp-content/uploads/2023/04/The-Southerly-at-Heron-Creek-1.jpg

430

1427

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-04-14 09:40:432024-08-21 16:47:27Patterson Brokers Construction Financing for Multifamily Development in North Port, FL

https://pattersonreag.com/wp-content/uploads/2023/04/The-Southerly-at-Heron-Creek-1.jpg

430

1427

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-04-14 09:40:432024-08-21 16:47:27Patterson Brokers Construction Financing for Multifamily Development in North Port, FL https://pattersonreag.com/wp-content/uploads/2023/03/Carter.png

790

1427

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-03-29 10:44:062024-08-21 16:48:04Patterson Facilitates Construction Financing for Carter’s Story Multifamily Portfolio

https://pattersonreag.com/wp-content/uploads/2023/03/Carter.png

790

1427

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-03-29 10:44:062024-08-21 16:48:04Patterson Facilitates Construction Financing for Carter’s Story Multifamily Portfolio https://pattersonreag.com/wp-content/uploads/2023/02/Newsletter-1.png

838

646

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-02-28 09:15:432024-08-21 11:53:22Patterson Issues Winter 2023 Edition of Newsletter: Capital Views

https://pattersonreag.com/wp-content/uploads/2023/02/Newsletter-1.png

838

646

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-02-28 09:15:432024-08-21 11:53:22Patterson Issues Winter 2023 Edition of Newsletter: Capital Views https://pattersonreag.com/wp-content/uploads/2022/03/Promotions-Press-Release.png

720

1071

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-02-07 09:59:122024-08-21 16:54:09Patterson Announces Multiple Promotions

https://pattersonreag.com/wp-content/uploads/2022/03/Promotions-Press-Release.png

720

1071

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-02-07 09:59:122024-08-21 16:54:09Patterson Announces Multiple Promotions https://pattersonreag.com/wp-content/uploads/2023/03/Storehouse-89.png

447

800

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-01-31 12:03:212024-08-21 16:54:42Patterson Arranges Financing for Redevelopment of Historic Naval Storehouses in Charleston, SC

https://pattersonreag.com/wp-content/uploads/2023/03/Storehouse-89.png

447

800

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-01-31 12:03:212024-08-21 16:54:42Patterson Arranges Financing for Redevelopment of Historic Naval Storehouses in Charleston, SC https://pattersonreag.com/wp-content/uploads/2023/01/Village-Park-Center-1.jpg

480

386

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-01-31 10:13:252024-08-21 16:55:11Patterson Arranges Construction Financing for Build-To-Rent Community in The Villages, FL

https://pattersonreag.com/wp-content/uploads/2023/01/Village-Park-Center-1.jpg

480

386

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2023-01-31 10:13:252024-08-21 16:55:11Patterson Arranges Construction Financing for Build-To-Rent Community in The Villages, FL https://pattersonreag.com/wp-content/uploads/2022/11/Ken-ULI.png

720

1280

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2022-11-18 11:33:272024-08-28 10:14:20Ken Grimes Serves as Conference Chair for ULI South Carolina Capital Markets Conference

https://pattersonreag.com/wp-content/uploads/2022/11/Ken-ULI.png

720

1280

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2022-11-18 11:33:272024-08-28 10:14:20Ken Grimes Serves as Conference Chair for ULI South Carolina Capital Markets Conference

https://pattersonreag.com/wp-content/uploads/2022/11/Lake-Point-Commerce-Center.jpg

731

1056

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-11-01 08:48:392024-08-21 16:57:03Patterson Brokers Acquisition Financing for 134,000 SF Flex Portfolio in Orlando, FL

https://pattersonreag.com/wp-content/uploads/2022/11/Lake-Point-Commerce-Center.jpg

731

1056

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-11-01 08:48:392024-08-21 16:57:03Patterson Brokers Acquisition Financing for 134,000 SF Flex Portfolio in Orlando, FL https://pattersonreag.com/wp-content/uploads/2022/10/ICSC@Southeast.jpeg

481

640

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-19 11:13:182024-08-28 10:16:24Patterson CEO Participates in ICSC Southeast Panel

https://pattersonreag.com/wp-content/uploads/2022/10/ICSC@Southeast.jpeg

481

640

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-19 11:13:182024-08-28 10:16:24Patterson CEO Participates in ICSC Southeast Panel https://pattersonreag.com/wp-content/uploads/2022/10/Barry-Olson-8239-Cropped-scaled.jpg

2322

2560

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-06 10:26:372024-08-21 16:58:22Patterson Expands into Texas and Welcomes Barry Olson as Senior Managing Director

https://pattersonreag.com/wp-content/uploads/2022/10/Barry-Olson-8239-Cropped-scaled.jpg

2322

2560

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-06 10:26:372024-08-21 16:58:22Patterson Expands into Texas and Welcomes Barry Olson as Senior Managing Director https://pattersonreag.com/wp-content/uploads/2022/10/Madison-Fountains_Nocatee_.jpg

785

1388

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-05 12:26:302024-08-21 16:58:47Patterson Arranges Financing for Construction of 276-unit Multifamily Development in St. Johns, FL

https://pattersonreag.com/wp-content/uploads/2022/10/Madison-Fountains_Nocatee_.jpg

785

1388

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-05 12:26:302024-08-21 16:58:47Patterson Arranges Financing for Construction of 276-unit Multifamily Development in St. Johns, FL https://pattersonreag.com/wp-content/uploads/2022/10/Daniel-Island-Phase-II.jpg

746

858

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-04 15:48:502024-08-21 16:59:14Patterson Facilitates Construction Financing for 41-unit Luxury Condo Development on Daniel Island

https://pattersonreag.com/wp-content/uploads/2022/10/Daniel-Island-Phase-II.jpg

746

858

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-10-04 15:48:502024-08-21 16:59:14Patterson Facilitates Construction Financing for 41-unit Luxury Condo Development on Daniel Island

https://pattersonreag.com/wp-content/uploads/2022/09/Luke-Javi-1.jpg

436

791

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-09-19 10:50:552024-08-21 17:01:21Patterson Promotes Javi Morales and Welcomes New Employee Luke Christian

https://pattersonreag.com/wp-content/uploads/2022/09/Luke-Javi-1.jpg

436

791

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-09-19 10:50:552024-08-21 17:01:21Patterson Promotes Javi Morales and Welcomes New Employee Luke Christian https://pattersonreag.com/wp-content/uploads/2022/09/Madison-Century-Farms_-1030x558-1.jpg

558

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-09-12 10:53:152024-08-21 17:01:45Patterson Facilitates Construction Financing for 266-Unit Multifamily Development in Nashville, TN

https://pattersonreag.com/wp-content/uploads/2022/09/Madison-Century-Farms_-1030x558-1.jpg

558

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-09-12 10:53:152024-08-21 17:01:45Patterson Facilitates Construction Financing for 266-Unit Multifamily Development in Nashville, TN

https://pattersonreag.com/wp-content/uploads/2022/09/117-SE-Parkway-1.jpg

572

889

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-09-06 10:48:252024-08-28 09:48:51Patterson Arranges Financing for Acquisition of 200,000 SF Industrial Asset in Franklin, TN

https://pattersonreag.com/wp-content/uploads/2022/09/117-SE-Parkway-1.jpg

572

889

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-09-06 10:48:252024-08-28 09:48:51Patterson Arranges Financing for Acquisition of 200,000 SF Industrial Asset in Franklin, TN https://pattersonreag.com/wp-content/uploads/2022/09/Challenger-South-1030x658-2.jpg

658

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-10 10:45:222024-08-28 10:21:47Patterson Sources Financing for Acquisition of Flex Office Portfolio in Orlando, FL

https://pattersonreag.com/wp-content/uploads/2022/09/Challenger-South-1030x658-2.jpg

658

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-10 10:45:222024-08-28 10:21:47Patterson Sources Financing for Acquisition of Flex Office Portfolio in Orlando, FL https://pattersonreag.com/wp-content/uploads/2022/09/Sayebrook.jpg

274

510

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-08 10:42:142024-08-28 10:26:26Patterson Brokers Construction Financing for Garden-Style Apartment Development in Myrtle Beach, SC

https://pattersonreag.com/wp-content/uploads/2022/09/Sayebrook.jpg

274

510

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-08 10:42:142024-08-28 10:26:26Patterson Brokers Construction Financing for Garden-Style Apartment Development in Myrtle Beach, SC https://pattersonreag.com/wp-content/uploads/2022/09/Summer-2022-1.jpg

898

791

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-04 10:38:402024-08-21 11:58:34Patterson Issues Summer 2022 Edition of Newsletter: Capital Views

https://pattersonreag.com/wp-content/uploads/2022/09/Summer-2022-1.jpg

898

791

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-04 10:38:402024-08-21 11:58:34Patterson Issues Summer 2022 Edition of Newsletter: Capital Views https://pattersonreag.com/wp-content/uploads/2022/09/New-Partner-Announcement-Image-1030x669-1.png

669

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-02 10:36:102024-08-28 10:29:02Patterson Announces Six New Partners

https://pattersonreag.com/wp-content/uploads/2022/09/New-Partner-Announcement-Image-1030x669-1.png

669

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-08-02 10:36:102024-08-28 10:29:02Patterson Announces Six New Partners https://pattersonreag.com/wp-content/uploads/2022/09/Hurstbourne-Park-Place-1-1030x795-1.png

795

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-26 10:30:252024-09-03 13:46:17Patterson Facilitates Financing for Two-Building Office Portfolio Acquisition in Louisville, KY

https://pattersonreag.com/wp-content/uploads/2022/09/Hurstbourne-Park-Place-1-1030x795-1.png

795

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-26 10:30:252024-09-03 13:46:17Patterson Facilitates Financing for Two-Building Office Portfolio Acquisition in Louisville, KY https://pattersonreag.com/wp-content/uploads/2022/09/River-Park-1.jpg

484

598

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-19 10:27:582024-08-28 11:42:44Patterson Arranges Construction Financing for Industrial Development in Jackson, GA

https://pattersonreag.com/wp-content/uploads/2022/09/River-Park-1.jpg

484

598

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-19 10:27:582024-08-28 11:42:44Patterson Arranges Construction Financing for Industrial Development in Jackson, GA https://pattersonreag.com/wp-content/uploads/2022/09/Northcreek-1-1030x544-1.jpg

544

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-13 10:21:422024-08-28 11:42:45Patterson Sources Construction Financing for Boutique Retail Development in Atlanta, GA

https://pattersonreag.com/wp-content/uploads/2022/09/Northcreek-1-1030x544-1.jpg

544

1030

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-13 10:21:422024-08-28 11:42:45Patterson Sources Construction Financing for Boutique Retail Development in Atlanta, GA https://pattersonreag.com/wp-content/uploads/2022/09/Grace-Lewis-scaled-e1663338340503.jpg

524

476

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-12 10:20:352024-08-28 11:43:19Patterson Welcomes New Employee Grace Lewis

https://pattersonreag.com/wp-content/uploads/2022/09/Grace-Lewis-scaled-e1663338340503.jpg

524

476

pauldehaven

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

pauldehaven2022-07-12 10:20:352024-08-28 11:43:19Patterson Welcomes New Employee Grace Lewis https://pattersonreag.com/wp-content/uploads/2022/07/1116-Polk-Avenue.jpg

624

1010

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2022-07-06 09:24:232024-09-03 13:49:21Patterson Sources Financing for the Refinance of a Two-Building Industrial Portfolio in Nashville, TN

https://pattersonreag.com/wp-content/uploads/2022/07/1116-Polk-Avenue.jpg

624

1010

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2022-07-06 09:24:232024-09-03 13:49:21Patterson Sources Financing for the Refinance of a Two-Building Industrial Portfolio in Nashville, TN https://pattersonreag.com/wp-content/uploads/2022/04/Charleston-Tech-Center-e1650656512104.jpg

524

565

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg

Suzanne Holman2022-06-09 10:50:482024-08-28 10:27:26Patterson Brokers Financing for the Refinance of Class-A Office Building in the center of Charleston’s “NoMo” Neighborhood

https://pattersonreag.com/wp-content/uploads/2022/04/Charleston-Tech-Center-e1650656512104.jpg

524

565

Suzanne Holman

https://pattersonreag.com/wp-content/uploads/2024/03/Patterson_logo_padding3.jpg